Snap Car Cash is on the rise and for a good reason. If you need immediate cash, you do not want to be left waiting. Take advantage of a quick car loan. With some of the lowest interest rates and flexible plans, we are here to help you on the road to financial stability. You can stay on the road while you do so as well since you get to keep your car during the repayment period. Snap Quick Car Cash is one of the easiest and most convenient solutions to any financial issues you may face.

Car Loan or Auto Quick Title Loans – What Are They?

An auto loan is just what it sounds like: A loan secured by your vehicle. These loans are easy to obtain, as they don’t need a credit history, and the loan amount is secured by the vehicle itself. A quick car loan is usually available in a few days, and it can be a instant and easy way to obtain cash if you are in need of cash.

Car or Auto Title Loan: How Do They Work?

A car loan is usually a short-term loan secured by an automobile . To secure a loan, the borrower must use their vehicle as collateral, since it is an asset. Taking out a loan against a car can often be easier due to the fact that they are secured, which makes them an excellent option for those with poor credit histories. A lien is placed on a vehicle once the borrower and lender agree on the terms of the loan. Permits are lifted once the loan is fully repaid.

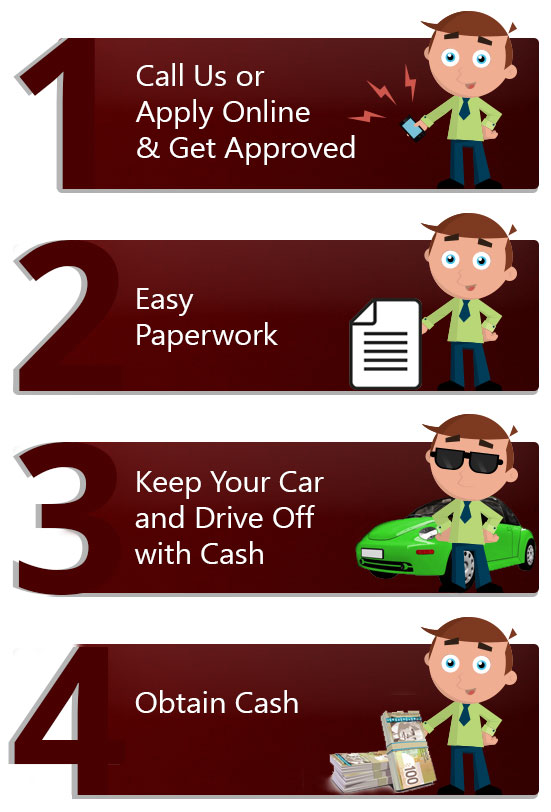

Applying For Quick Car Loan at Snap Car Cash

1. Call Us or Apply Online & Get Approved

Snap Car Cash has been lending money to Canadians through Car Loans since 2004. You too can get a quick cash loan with just one quick call or an online application. You will receive a call from us shortly after submitting your online application. Apply online now!

2. Easy Paperwork

We don’t care about your credit score. Don’t let your credit score or history keep you from applying for a car title loan. Your car’s title serves as collateral for your loan, so don’t worry about anything but moving forward. In our financing methods, we secure financing by the value of your vehicle, not your credit score. This means if you fully own any car, truck or motorcycle and you have a clear title, we can give you cash within 15 minutes!

3. Keep Your Car and Drive Off with Cash

Taking advantage of a loan will give you the ability to keep your car and drive away with cash. Your vehicle is your credit. Don’t let a loan process slow down your lifestyle.

4. Obtain Cash

We can lend you $ 1000 to $ 50,000. The amount we loan is determined by the wholesale value of your car. Among the factors that we consider are the year, make, model, mileage and condition of the vehicle. Fill out the online auto title loan application now!

What You Need

- Valid driver’s license

- Proof of residency.

- Your vehicle’s registration and insurance.

- The car must be paid off and in your name

- A vehicle inspection is necessary to receive a loan

How can a car title loan or auto title loan benefit you?

Apart from having the freedom of using money as you wish, there are several other benefits that you can get from an auto loan.

- A car loan is a secured loan and thus we do not run any credit checks.

- If you are in between jobs, you can still apply for a loan.

- You can avail of a long, loan payment term of up to four years.

- If you want to pay the loan before the end of the loan period, you’ll not be charged with prepayment penalties.

- You can keep and use your vehicle even during the loan period.

FAQs About Car Loan

What is the maximum amount of cash I can get through a title loan?

The maximum amount you can get is $50,000! Your loan amount will depend on the vehicle’s market value and the condition of your vehicle.

What do you mean by lien-free car titles?

Lien-free vehicle are those with no outstanding loans or judgments associated with them. The title of your car must be lien-free in order to qualify for a title loan from Snap Car Cash.

Are auto loans different than car loans?

In the case of a car loan, the vehicle is used to secure the loan, and it serves as collateral. After you have completely repaid your car loan, you can then apply for a loan using your vehicle as collateral. If you need money to purchase something, you can use a loan.

If I am still paying off my car loan, can I get a loan against my car?

In most cases, you won’t be able to get approved for an auto title loan if you don’t own your car outright. Because of this, if you default on your loan, the person who holds your car loan will be the first in line to get their money back. loan holders may not recover their money and will be second in line. This risk won’t appeal to most lenders.

Can I improve my credit by getting a loan?

You can improve your credit by taking advantage of the fact that your loan provider reports payments to one or both Canadian credit bureaus. Your credit score won’t be affected if they don’t report your payments. Always check with your lender before signing a contract if they report payments if you are interested in improving your credit.

Can I get an auto title loan with a low credit score?

Ultimately, it comes down to who you choose as a lender. Due to their secured nature, loans usually have fewer requirements (such as credit score limits). Despite a low credit score, you can still get approved even if your credit isn’t quite where you would like it to be.

Loan Fees:

The fees consist of an Auto Check (to check for accidents and vehicle origin), Lien Search (to make sure the vehicle is free and clear of all liens), and a Vehicle Inspection / Evaluation.

Loan Source & Renewal Policy:

Snap Car Cash Loans locates finance companies that provides five-year term loans with the lowest annual interest rate in the industry. There are no prepayment fees for early repayment of the loan.

The implication of late payment or non-payment

In the event of a late or partial payment, interest fees will be charged on a daily basis on the outstanding amount. Failure to pay will result in legal action, as per Personal Property Securities Act (PPSA) British Columbia, Alberta, Saskatchewan, Nova Scotia, New Brunswick, Prince Edward Island, Newfoundland & Labrador and Ontario.